Swiss Money Managers: Guide to Active Portfolio Management & Monitoring

In the ever-changing landscape of global finance, high-net-worth individuals understand that protecting and nurturing their wealth requires more than just smart investment choices. Monitoring and adjusting your portfolio while staying disciplined in rising and falling […]

Read More

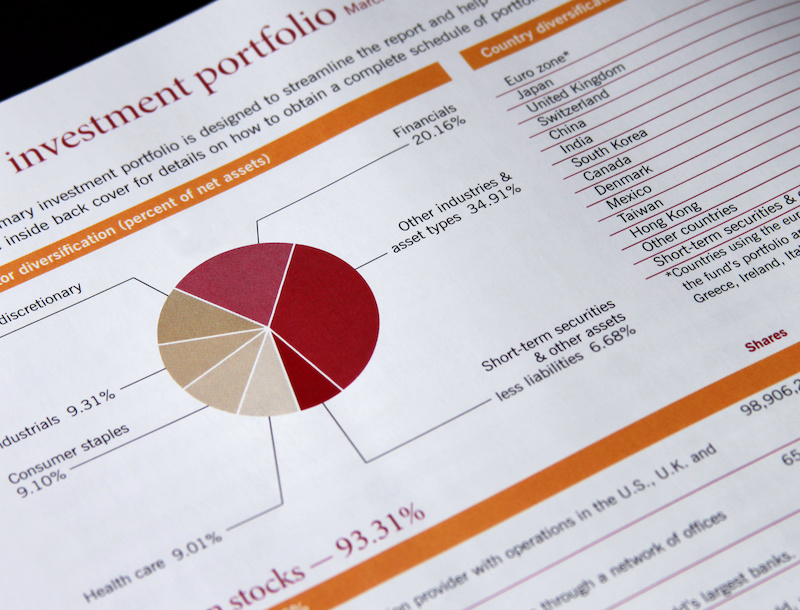

Unlocking the Power of Asset Diversification for Financial Success The Swiss Asset Management Way

In the ever-changing world of investment management, ensuring the longevity and growth of your wealth requires a robust and resilient approach. Asset diversification is a cornerstone of this strategy, and Swiss wealth management firms have […]

Read More

Swiss Money Management: Understanding and Navigating Volatile Markets through Diversification

In an era of rapid economic changes and unpredictable market fluctuations, understanding volatile markets has become more crucial than ever for investors. One approach that has proven to be effective in mitigating the risks associated […]

Read More

Global Investment Strategy Options in the Face of the Weakening U.S. Dollar

The U.S. dollar has been steadily losing its purchasing power over time, leading to a number of currency-related challenges for global investors. With weakening purchasing power both domestically and abroad, individuals and businesses alike must […]

Read More

What to do as the Power of a Dollar Diminishes

2022 saw record high inflation, and though things have cooled slightly as the first quarter of 2023 nears its end, experts are predicting higher levels of inflation for the next few years when compared to […]

Read More

How Wealth Management in Switzerland can Diversify Your Portfolio

Swiss asset management firms have been renowned around the world for years by investors for their proven track record in global investment strategies. The majority of Swiss wealth advisors have proven time and time again […]

Read More

How to Protect Your Wealth From Inflation During Times of Global Tension

The past year saw record-high levels of inflation, as well as its fair share of global tension. As is the case in inflationary environments, investors naturally ran towards what they thought would be good hedges […]

Read More

Swiss Francs: Investing in One of the World’s Most Stable Currencies

Switzerland has long been celebrated for its currency’s stability, and the Swiss franc is widely regarded around the world as a go-to option for anyone looking to get serious about their global investment strategy. Although […]

Read More

Where We Have Gone, And Where We May Go In The Stock Market

2022 was an eventful year for the stock markets and the world economy. Record high inflation, continued fallout from the pandemic, and other global events are just a few noteworthy events that made 2022 quite […]

Read More

How to Diversify Your Portfolio with Swiss-based Investing

Clever investors have been diversifying their portfolios by taking advantage of global investment options for generations. For wealthy U.S.-based investors, Swiss asset management has been a tried and true investment strategy they have utilized to […]

Read More

Investing With Swiss Francs: One of the World’s Most Stable Currencies

The Swiss franc (CHF) has a long history of being a safe investment in the financial world and has long been a staple of Swiss asset management. The 2008 financial crisis saw considerable investors, nervous […]

Read More

What are the Rewards and Risks When You Invest Outside U.S. Markets?

Your current portfolio may be domestic, international, or global. This geographical distinction may be based on where companies are headquartered or where companies derive most of their earnings. For example, a U.S.-based company may derive […]

Read More

Investing In Swiss Francs Can Help Protect Your Assets During Inflationary Times

Switzerland is not a member of the European Union so it has not converted its currency to Euros. It has chosen to continue using the Swiss franc (ISO code CHF) which is considered to be […]

Read More

How Will The Upcoming U.S. Elections Impact The Performance Of My Assets?

With possible changes to healthcare, tax, and technology regulations that hinge on the outcome of the elections, planning ahead for possible impacts on your portfolio may make sense for your situation. Assuming history is a […]

Read More

How Will Midterm Elections Impact The Future Performance Of The U.S. Stock Market?

As a registered U.S. citizen, every two years you have a moral responsibility to vote for politicians. We can’t predict the outcomes of election results, but we can provide some insight into how the securities […]

Read More

Why Is Global Investing Your Best Strategy During Periods of Market Volatility?

The number one reason why more investors are thinking global is diversification. They are looking for global investment opportunities that help them protect their principal and produce better returns for their assets. At the same […]

Read More

Which Investments Can Produce Better Returns In A Volatile Market?

Inflation, recession, and stagflation are just three of the current economic conditions that are causing substantial volatility in the global securities markets. Investing during these market conditions can be challenging, but it should not be […]

Read More

The Impacts Of U.S. Inflation On My Savings

Are you feeling lost in the thick of inflation, not knowing where to turn for reliable insight? If you’re not sure how to determine whether your savings account is losing money, LFA has some tips […]

Read More

How To Protect My Savings From U.S. Inflation

Inflation is the silent killer of your savings. Since the U.S. dollar has lost more than 95% of its value since 1913, it’s likely that you’ve seen this firsthand in your own life: a dollar […]

Read More

Will There Be A Recession In America?

Threats of an upcoming recession in America have many consumers and investors in a panic. Are you one of them? Those who remember the Great Recession of 2008 are familiar with how it can impact […]

Read More