In the ever-changing landscape of global finance, high-net-worth individuals understand that protecting and nurturing their wealth requires more than just smart investment choices. Monitoring and adjusting your portfolio while staying disciplined in rising and falling markets are essential for pursuing financial success.

As you consider your options for wealth management, Switzerland’s expertise in this field may be a viable alternative for managing all or a portion of your investable assets.

In this blog post, we will delve into:

- The World Of Swiss Money Management

- How To Monitor Your Portfolio’s Performance

- How To Adjust Your Investments Based On Market Fluctuations

- The Importance Of Minimizing Emotional Reactions To Market Fluctuations

Read our latest Guide: Navigating Volatile Markets: A Guide to Asset Diversification from a Swiss Money Management Firm

The World Of Swiss Money Management

Swiss money management services have long been sought after by High Net Worth Individuals (HNWIs) due to their reputation for asset protection, privacy, and financial stability. In volatile markets, these features can provide HNWIs with an investment process that protects and nurtures their wealth, even during unstable market conditions.

The multi-generational Swiss bank tradition boasts a strong regulatory framework, which has fostered a high degree of trust in the expertise of Swiss money managers.

Furthermore, Swiss Bank Accounts can offer confidentiality and diversification opportunities.

Tax optimization and compliance can also play a significant role in the appeal of Swiss-based money management services. These services typically provide major efficiencies through cross-border investment opportunities and a thorough understanding of international tax codes.

In addition, Swiss financial institutions must adhere to a robust regulatory framework that includes compliance with the Foreign Account Tax Compliance Act (FATCA) and the Automatic Exchange of Information (AEOI). This could help preserving and protecting your liquid net worth wealth while minimizing tax neutrality and fulfilling your global tax obligations.

How LFA Can Help: At LFA, we specialize in developing personalized portfolios and holistic wealth management strategies tailored to your unique risk tolerance, tax liabilities, and financial goals.

How To Monitor Your Portfolio Performance

To achieve your portfolio’s performance goals effectively, it is essential to have a clear investment strategy and financial plan in place. Regularly evaluating your portfolio’s performance against relevant benchmarks enables you to make informed decisions on rebalancing your investments and preserving your desired exposure to risk. Performance measurement and benchmarking are crucial components of portfolio monitoring.

Swiss-based financial planning professionals can also help you establish the relevant benchmarks that accurately reflect the performance metrics of your chosen asset classes. This allows you to assess your portfolio’s performance concerning your financial goals and broader market trends.

Tax efficiency also plays a vital role in maximizing your portfolio’s returns. Swiss wealth management professionals can advise on global tax-efficient investment strategies, helping to ensure that your wealth preservation efforts are optimized.

Regular portfolio rebalancing is another aspect of monitoring your portfolio’s performance while maintaining your desired risk exposure. As market conditions change, your asset allocation may evolve from your original investment strategy, potentially exposing you to unwanted risks or diminishing returns.

Swiss wealth management services can help you identify these imbalances and adjust your investments to maintain your desired level of diversification and risk.

How LFA Can Help: The LFA team can provide you with the tools and expertise necessary to pursue long-term financial success with a proactive approach to portfolio monitoring and a commitment to aligning your investments with your financial goals.

How To Adjust Your Investments Based On Market Fluctuations

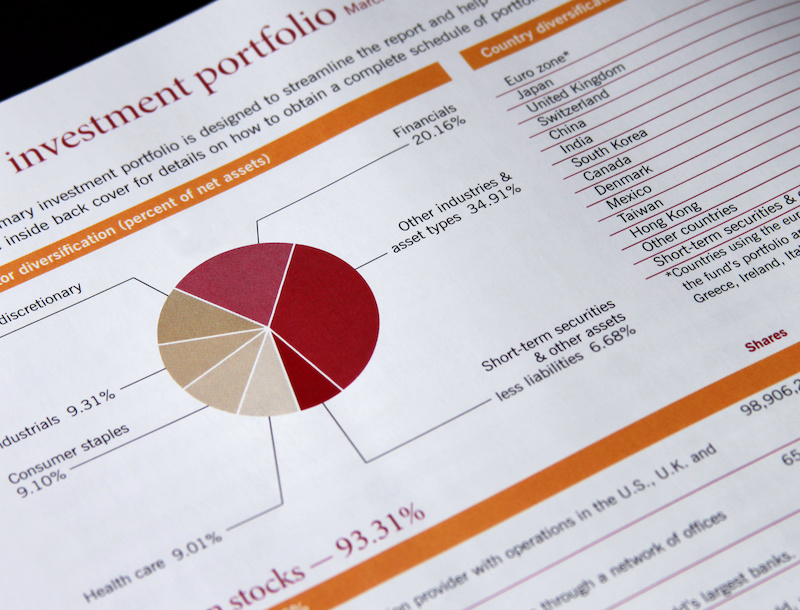

Maintaining a desired level of diversification is one of the first steps to effectively balancing your portfolio’s investments based on current and anticipated stock market fluctuations. This means allocating your investments across different asset classes, industries, and geographies, which can help mitigate potential risk and achieve more stable returns.

It is also crucial to assess your risk tolerance to create an investment strategy that aligns with your unique financial situation and investment goals. Your risk tolerance should be based on your capacity to take risks.

It is also crucial to assess your risk tolerance to create an investment strategy that aligns with your unique financial situation and investment goals. Your risk tolerance should be based on your capacity to take risks.

One proven method for reallocating your investments is by rebalancing your portfolio periodically. Rebalancing involves buying and selling securities to maintain your desired asset allocation levels. This can help you realign your portfolio based on your original asset allocation and risk tolerance.

You should pursue a disciplined approach to rebalancing and resist the urge to follow short-term market trends. Instead, focus on your long-term strategy and make necessary adjustments to help keep your investments on track toward achieving your actual goals.

Lastly, you and your Swiss-based financial advisor should conduct a scheduled portfolio review to identify areas that may require changes that could meet your current and future needs. This can include evaluating your current holdings, assessing your investment goals, managing risk exposure, and understanding how market fluctuations may impact your portfolio’s future performance.

How LFA Can Help: LFA conducts regular reviews to help you identify new investment opportunities and make well-informed decisions based on current market conditions. By staying proactive and informed, you can pursue a more flexible investment strategy and be better prepared to cope with market fluctuations and navigate the ever-changing financial landscape.

The Importance Of Avoiding Emotional-Backed Investment Decisions

When markets fluctuate, stay level-headed and focus on your long-term goals. By avoiding impulsive actions and keeping emotions in check, you can make more rational decisions that align with your long-term objectives, ultimately increasing the likelihood of achieving your financial goals.

Emotional reactions to market changes, such as panic selling and FOMO (Fear of Missing Out), can damage your long-term strategy. Panic selling often occurs when investors allow their emotions to dictate their actions, resulting in sales that produce realized losses.

Similarly, FOMO can drive investors to make hasty, knee-jerk decisions, such as buying when prices are high and selling when prices are low.

To maximize long-term success, remain steadfast in your strategies and avoid making decisions based solely on emotional responses to market changes. Effective risk management, diversification, and emotional intelligence are essential to a potentially successful investment strategy.

How LFA Can Help: By adhering to disciplined risk management and diversification principles, we can help you minimize the damaging impact of emotion-backed investment decisions during volatile markets.

Considering a global diversification strategy for your investments? Connect with the LFA team to learn more about their specialized services for successful high-net-worth individuals and their families.