This article, titled “The Americans’ Switzerland,” is commentary from Paolo Panza, CEO of LFA, part of the LFG Holding Group. It discusses the rapidly changing role of Switzerland and the Swiss franc in the eyes of US citizens, noting that the strong franc has reaffirmed its position as a traditionally recognized safe-haven currency and stable pillar for global portfolios. The piece analyzes how this phenomenon has evolved beyond capital migration, with a growing number of high-net-worth American families choosing to physically relocate to Switzerland, driven by factors like currency strength, political neutrality, and a stable financial ecosystem.

The role of the Confederation and the franc in the eyes of US citizens is rapidly changing. It is no longer a preferred destination for capital alone, but also for people.

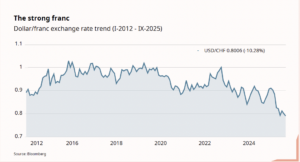

Over the last ten years, the dollar-franc exchange rate has traced the map of a growing confidence in the Swiss Franc.

From values close to parity in the second half of the 2010s to levels around 0.80 in recent months, the franc has reaffirmed its position as a traditionally recognized safe-haven currency. For American investors, this isn’t just a technical indicator: the movement suggests growing interest in Switzerland as a potential stable pillar in global and multi-asset portfolios. Wealth migration in evolution. According to the Swiss Bankers Association, Switzerland manages approximately 2.4 trillion francs in foreign assets, equal to nearly a quarter of global cross-border wealth (Banking Barometer 2024). This record reflects not only the strength of the franc, but also a historically stable, innovative, and internationally recognized financial ecosystem. This has led to growing interest among savers.

Americans to Switzerland. The nature of this migration has changed. In the past, the rationale was protectionist: a franc account was often considered a form of protection in the event of extreme events. Today, the franc is no longer viewed merely as a defensive asset, but increasingly as a long-term strategic component. Switzerland is thus becoming a strategic hub for American interests overseas, capable of engaging with the markets and embedded in a historically stable environment, with a currency recognized for its solidity and a specialized financial system. The new dynamics. For decades, part of American wealth has found a safe haven here, but in recent months the phenomenon has evolved: not just capital, but also a growing, albeit residual, number of high-net-worth families are choosing to physically relocate. Rising global geopolitical tensions have accelerated the process already underway. What began as a selective and tactical migration of capital is transforming into a more dynamic.

A broad perspective, combining asset diversification, a search for security, and, in some cases, even a lifestyle choice. According to the Federal Statistical Office, at the end of 2023, over 31,900 US citizens lived permanently in Switzerland: a still small but growing number, reflecting the country’s growing attractiveness not only as a destination for capital but also as a place to settle. Common historical roots. The United States and Switzerland have shared common ground for decades: a deeply rooted belief in democracy and a commitment to the American Constitution, instrumental to political stability and economic progress. Neutrality: an intangible asset. An equally important factor is Switzerland’s neutrality, which in times of war or geopolitical crisis has always strengthened the perception of security for international investors. It doesn’t appear on balance sheets, but it is a factor often considered in long-term investment decisions. For American families seeking stability, knowing that Switzerland maintains an independent and globally respected position is an asset that goes beyond currency advantage: it is an intangible asset that supports trust and continuity. A choice that is becoming more and more consolidated. It is therefore thanks to the combination of currency strength, political neutrality and a consolidated reputation in Management that Switzerland remains a recognized point of reference in this evolution for a growing number of Americans seeking stability and long-term prospects.

Click here for the original article as a PDF