The year opened with developments that prompted renewed reflection on the broader geopolitical framework. The U.S. operation in Venezuela in early January, culminating in the arrest of President Nicolás Maduro, marked a further step in the escalation of Washington’s foreign policy posture. While the immediate market impact was limited, the episode set the tone for the opening of the year. Around the same time, renewed and at times confrontational rhetoric from President Trump regarding U.S. strategic interests in Greenland—ranging from proposals to acquire the territory to explicit references to the possible use of force, alongside broader assertions tied to Arctic security—was accompanied by pressure on allies. Trade policy also re-emerged as a negotiating instrument. President Trump openly threatened the introduction of 25% tariffs on several European countries—including Denmark, Germany, France, and the UK—explicitly linking trade measures to U.S. demands over Greenland. The episode marked an unusually direct use of tariffs as geopolitical leverage rather than as a tool of economic policy. The episode later de-escalated at the World Economic Conference in Davos, where President Trump stepped back from these positions, pledging not to resort to either military force or trade measures. Meanwhile, unrest in Iran persisted, alongside a further escalation in U.S. rhetoric. Taken together, however, these developments reinforced the perception of a more multipolar, increasingly fragmented global environment.

The year opened with developments that prompted renewed reflection on the broader geopolitical framework. The U.S. operation in Venezuela in early January, culminating in the arrest of President Nicolás Maduro, marked a further step in the escalation of Washington’s foreign policy posture. While the immediate market impact was limited, the episode set the tone for the opening of the year. Around the same time, renewed and at times confrontational rhetoric from President Trump regarding U.S. strategic interests in Greenland—ranging from proposals to acquire the territory to explicit references to the possible use of force, alongside broader assertions tied to Arctic security—was accompanied by pressure on allies. Trade policy also re-emerged as a negotiating instrument. President Trump openly threatened the introduction of 25% tariffs on several European countries—including Denmark, Germany, France, and the UK—explicitly linking trade measures to U.S. demands over Greenland. The episode marked an unusually direct use of tariffs as geopolitical leverage rather than as a tool of economic policy. The episode later de-escalated at the World Economic Conference in Davos, where President Trump stepped back from these positions, pledging not to resort to either military force or trade measures. Meanwhile, unrest in Iran persisted, alongside a further escalation in U.S. rhetoric. Taken together, however, these developments reinforced the perception of a more multipolar, increasingly fragmented global environment.

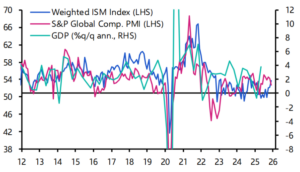

Beyond the geopolitical developments, incoming data from the United States continued to portray an economy that remains resilient, though increasingly uneven. On the one hand, the manufacturing sector remained mired below the recessionary threshold—ISM manufacturing printed at 47.9, down from 48.2, missing expectations and marking ten consecutive months below the 50 threshold. On the other, the services sector, which underpins the bulk of U.S. domestic demand, delivered a solid beat with the ISM services index at 54.4, comfortably above forecasts and the highest level since October 2024. This split—goods weak, services strong—has become a recurring pattern that complicates straightforward interpretation, as indicators alternately point to slowdown and resilience. The labor market provided a similar contrast. Payrolls increased by only 50,000—a marked slowdown from prior months and well below consensus expectations—yet the unemployment rate ticked lower to 4.4%, helped in part by a decline in labor force participation. Inflation continued its gradual descent, with core CPI easing to 2.6% year-over-year. While this incremental progress fits the softening narrative, it exists alongside GDP figures that remain surprisingly strong, with the latest revision of annualized third-quarter growth at 4.4%. The economy has not grown at a faster pace since the third quarter of 2023 and continues to be supported by solid consumer spending, though increasingly reliant on higher-income households, with the top 10% of U.S. earners accounting for a record 49% of total consumption. In this setting, the Federal Reserve’s decision to leave policy rates unchanged toward the end of January was fully anticipated. While not unanimous—two out of twelve members dissented in favor of a 25-basis-point cut—the choice to keep the federal funds target range at 3.50%–3.75% reflected the recent solid pace of GDP growth and early signs of stabilization in the unemployment rate. More telling, perhaps, was the nomination of Kevin Warsh as the next Federal Reserve Chair. As discussed in our previous commentary, speculation around the succession to Jerome Powell had become an increasingly relevant theme toward the end of last year; January provided clarity on that front. A former Fed governor with long-standing hawkish views, Warsh’s appointment has brought renewed attention to his skepticism toward prolonged balance sheet expansion. More recently, however, he has also shown some convergence with the administration’s view that productivity gains—particularly those linked to advances in artificial intelligence—could help support lower interest rates without reigniting inflation pressures.

A final word regarding the earnings season, which took off on a solid footing. Among S&P 500 companies that have reported so far, 84% exceeded earnings expectations, while 59% have delivered revenues above consensus estimates. Notably, around 53% of reporting companies have posted so-called “double beats,” outperforming expectations on both sales and net income. At this early stage of the reporting season, the data point to broadly resilient corporate fundamentals as the year gets underway.

Shifting the focus to the Old Continent, Europe entered the year with macro data that were broadly stable but unremarkable. Eurozone GDP grew by 1.3% year-over-year in the final quarter of 2025, broadly in line with expectations, while core inflation hovered near 2.3%. Within this evolving global context, Europe also took tangible steps to diversify its trade relationships, signing a new agreement with India. While the economic impact may unfold gradually, the agreement reflects a broader effort to adapt to a more fragmented and transactional global trade environment, reducing reliance on traditional transatlantic and China-centric supply chains. Moving eastward, China’s economic momentum continued to soften, consistent with the broader trend of gradual deceleration as stimulus effects faded and domestic demand remained subdued. Fourth-quarter GDP growth eased to around 4.4%, down from 4.8% in the prior quarter, even as full-year 2025 growth met the official target of 5.0%, underscoring persistent structural headwinds in consumption and private investment. In Japan, the focus shifted from cyclical activity to the interaction between fiscal policy and market pricing. Prime Minister Sanae Takaichi’s decision to call early general elections for mid-February 2026 comes amid expectations of a strong victory for her ruling coalition and a mandate for more expansionary fiscal measures. Political developments have coincided with upward pressure on long-dated Japanese government bond yields, which have climbed to levels not seen in decades as markets price in the risks associated with potential tax cuts, higher spending, and ongoing stimulative measures.

The year began on a positive note for major equity markets, despite a backdrop of elevated volatility, as described above. The Euro Stoxx 600 closed the month up +3.24% in local currency terms, followed by the MSCI World (+2.26%) and U.S. indices, with the S&P 500 gaining +1.44% and the Nasdaq 100 rising +1.23%. At the sector level, metals and mining stocks outperformed, benefiting from the sharp rally in gold, as did the Energy sector, supported by higher oil and natural gas prices.

On the fixed-income side, January once again proved favorable for corporate credit, despite the aforementioned uncertainties. The investment-grade segment advanced by 79 basis points in Europe and by 36 basis points in the United States. High yield also delivered positive returns, gaining +0.68% in Europe and +0.48% in the U.S. Emerging market bonds kept pace, posting a gain of 53 basis points in USD terms. The comments by Chair Powell who described the U.S. economy as “solid,” compared with the “moderate” assessment used at the previous meeting, and characterized the inflation backdrop as “modestly positive,” expressing confidence that inflationary pressures are unlikely to reaccelerate, resulted in U.S. Treasury yields moving higher, with the 2-year closing at 3.52% and the 10-year at 4.24%. In contrast, yield curves in Germany and Switzerland shifted lower, with 2-year yields at 2.09% and -0.17%, and 10-year yields at 2.84% and 0.21%, respectively.

In commodities, as anticipated, oil prices rose sharply following a volatile period. Prices initially declined after the U.S. attack in Venezuela and the detention of President Maduro, as investors began to price in a potential increase in supply. Subsequently, oil rebounded on the back of renewed heavy Russian attacks in Ukraine and, most notably, a verbal escalation between the U.S. and Iran, the repositioning of U.S. forces closer to Iran, and threats of a possible disruption to oil flows through the Strait of Hormuz, which accounts for roughly 20% of global oil supply. Alongside oil, both gold and silver recorded a remarkable rally in January. Gold closed the month up +13.31%, while silver gained +18.89%, despite a sharp pullback in the final days of the month. The rally was driven by uncertainty surrounding the future leadership of the Federal Reserve and concerns over its independence, ongoing geopolitical developments, and strong inflows from retail investors.

In currency markets, the U.S. dollar moved in the opposite direction to gold, depreciating against major currencies for most of the month before recovering part of its losses toward month-end. The EUR/USD exchange rate closed at 1.1851 (+0.89%), while USD/CHF ended at 0.7730 (-2.47%). Lastly, Bitcoin extended the weakness observed in the previous month, declining by 3.98% and closing at USD 84,162.39.

In January, our discretionary portfolios slightly underperformed the benchmark. Fixed income performance was broadly in line, with government and agency bonds the largest detractor, driven by a relative overweight combined with a broad upward shift in the U.S. yield curve.

Equities also trailed the benchmark. The overweight to U.S. Small and Mid-Caps, Amazon, and the Hive Equity Fund contributed positively and supported relative performance. However, a lower allocation to Emerging Markets generated negative allocation effects, ultimately leading to underperformance within the equity sleeve. Diversification across Europe and Switzerland once again proved beneficial, contributing positively over the period.

Alternative investments were the main source of underperformance and accounted for the majority of the overall detraction but, we are still missing the updated NAV of the fund of funds and, presumably, the underperformance will be reduced once the former will be published. In contrast, commodities provided a positive contribution through selection effects, supported by exposure to gold and gold miners, which continued to appreciate amid persistent geopolitical uncertainty and a weakening U.S. dollar.

In terms of transactions, during January we have increased the exposure towards European equities, by engineering an instrument that allows participating to the positive performance of the Euro Stoxx 600, while avoiding any downside risks.